Table of Contents

ToggleAt this point in history, even grandmothers have heard about Bitcoin. From “I’ve heard about that Bitcoin thing” to actually understanding what this world is all about, there’s quite a journey to embark on. But hey, in this article, you’ll get the essential and specific information that will leave you informed and ready to join the conversation at dinner with friends.

A significant part of people worldwide don’t fully understand how fiat money works, and even fewer have dedicated time to understand cryptocurrencies and why they say Bitcoin is digital gold. So congratulations! Let’s start unraveling what Bitcoin is and how it works.

What is Bitcoin and how does it work?

Bitcoin is a digital currency or cryptocurrency created in January 2009 by Satoshi Nakamoto, a person or group of people who remain under the pseudonym.

According to the technical paper Nakamoto used to introduce Bitcoin to the world, Bitcoin is “a person-to-person electronic cash system, a purely peer-to-peer form of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution.” In other words, Bitcoin was born as a monetary alternative to the fiat system.

What Is Fiat Currency?

Fiat money, also known as Fiat, is money by decree. This term refers to a currency whose quality as money is granted through a state declaration.

Fiat money includes euros, dollars, or pesos. When referring to fiat currencies, Nakamoto emphasizes that legal tender is characterized by being a currency with no intrinsic value.

It’s essential to note that this wasn’t always the case; before 1971, the US dollar and most fiat currencies were backed by the gold standard. However, President Richard Nixon controversially announced that currencies would no longer be backed by corresponding gold reserves. From then on, their value would be based solely on legal tender guaranteed by the state and accepted by the community. Therefore, their value is generated by the relationship between supply and demand.

So why Bitcoin? What makes Bitcoin unique?

Bitcoin seeks to redefine money by using a platform of decentralized transactions that don’t rely on third parties and has a known limited supply: only 21 million bitcoins will ever exist. But what does this mean?

By 2008, the world had been off the gold standard for 37 years, and there had been multiple worldwide economic downturns. The most recent significant episode of global financial turmoil was the 2008 housing bubble, which occurred a year before Bitcoin’s creation.

The reality is that fiat money is broken, lacks backing, and Bitcoin emerges as an alternative to a new monetary system, one where transparency, decentralization, and the impossibility of third parties manipulating money at their will are the law (and the code).

The concept of digital currency isn’t new. However, Bitcoin was the first version of digital money that actually worked: it offers an open network, free from trusted third parties and without control by centralized entities, to anyone in the world. Bitcoin offers monetary freedom.

It’s essential to highlight that Bitcoin’s contributions to current society go beyond monetary aspects; there is also a significant technological component. Bitcoin introduced the concept of the blockchain, or distributed ledger technology, which has served as the basis for technological developments that are reshaping the world.

How many Bitcoin (BTC) are in circulation?

Bitcoin is a currency with a limited supply from its creation. It’s established in Bitcoin’s whitepaper that there will be a maximum of 21 million bitcoins, and unlike other cryptocurrencies that were born after BTC, it wasn’t pre-mined, and no coins were minted or distributed before the software became public. This is one of the features that add the most value to Bitcoin, as it prevents the monetary elasticity that has caused many problems with fiat money. Bitcoin is scarce and immutable.

What gives Bitcoin value?

Bitcoin is recognized by monetary experts as digital gold because it is scarce, durable, and has money-like qualities. But let’s explore what gives value to Bitcoin a bit more.

First and foremost, it’s necessary to mention its finite supply of 21 million units. This level of scarcity is greater than that of some traditional commodities and marks a significant contrast with Bitcoin’s competitor: the fiat system. The fiat system allows governments and central banks to increase the money supply as they see fit, continuously degrading its value. With Bitcoin, this is impossible. Every BTC in existence and yet to be created follows an emission schedule established since its inception.

Additionally, Bitcoin is durable and transferable. As durable as gold, Bitcoin is designed to be used over time. In fact, it’s even more divisible than gold. Each BTC can be divided into 100 million pieces, commonly known as satoshis, in honor of the pseudonymous creator of the currency.

Like gold, Bitcoin is durable enough to be used over time. Unlike gold, Bitcoin is divisible into 100 million pieces per BTC, with a portability feature that makes it efficiently transferable in space and time.

Moreover, Bitcoin has managed to build a network effect. This means it’s accepted and used as a store of value and medium of exchange in millions of businesses worldwide. This is a historic milestone, as monetary adoption processes have historically been slow. Therefore, Bitcoin’s value will continue to grow with the adoption and use of BTC.

Before Bitcoin: Did cryptocurrencies exist?

Now that you know Bitcoin’s proposition, it’s essential to consider that Satoshi’s invention wasn’t the first attempt to create a system for exchanging digital money, what we now know as cryptocurrencies.

Bitcoin’s creation was a significant milestone for the Cypherpunk movement, which originated in the 1970s and included projects like B-money, Bit Gold, eCash, and HashCash. All these projects had flaws such as centralization, lack of privacy, lack of transparency, and others that were addressed by Nakamoto.

Who are the founders of Bitcoin?

Bitcoin is not a corporation or a centralised entity, so among its founders or creators, we only count Satoshi Nakamoto. A person or group of people who began writing code about a new monetary system under a pseudonym, and who more than 10 years later remains unknown.

This does not mean that Nakamoto is the only known cypherpunk who participated in the early stages and subsequent development of bitcoin. Several cryptographers such as Hal Finney, Nick Szabo, Wei Dai, and Adam Back have been involved in the development of bitcoin. However, all deny being Satoshi Nakamoto.

Bitcoin Mining: How each BTC is created

When Bitcoin was born in 2009, the mining process required little more than a home computer, and it didn’t need to be very fast or efficient. Nowadays, the evolution of the ecosystem has made mining a full-time job.

When we talk about Bitcoin mining, we refer to the generation of new blocks for the Bitcoin network. The construction of the blockchain is carried out through this mining activity, which allows maintaining a peer-to-peer network based on updated and secure blockchain technology.

This is how Bitcoin mining works:

All miners on the network compete to be the first to find the solution to their block’s cryptographic problem through a Proof of Work (POW) system, which involves solving a problem that requires multiple repeated attempts.

To validate each block, the probability of a miner solving the mathematical problem depends on the computing power they contribute to the network in relation to the combined computing power of all nodes. This allows the system to function in a decentralized manner.

When a miner finds the solution to their block’s cryptographic problem, they pass it on to the other nodes to which they are connected. In the event that the block is valid, the remaining nodes add it to the chain and transmit it. This process is repeated indefinitely until the block reaches all nodes on the network.

The blockchain contains the ownership history of all coins, from their issuance to the current owner’s address.

How is the Bitcoin Network Protected?

To explain how the Bitcoin network is protected, we need to review the incentive system that makes this decentralized network function.

The Bitcoin network is structured to work based on game theory. Therefore, what protects the Bitcoin network are the interests of all participants, particularly the miners. The Bitcoin network is protected by nodes and miners.

Miners use computational power to record and validate new transactions on the network through Proof of Work based on the SHA-256 hash algorithm. Why do they do it? Because they receive a substantial reward. To earn this reward, miners must compete in block production by solving complex calculations. These calculations have a difficulty that changes every 2016 blocks, and this adjustment is automatically set depending on the computational power deployed in the network.

At the same time, nodes validate that all transactions sent to the mempool comply with the network’s rules.

Bitcoin Reward and Halving

Bitcoin was created with a clear emission policy and rewards. From its creation until approximately the year 2140, bitcoins will be issued as rewards to miners.

The reward in 2009 started at 50 BTC for each mined block and halves every 210,000 blocks (approximately every 4 years) in a process called halving. Halving is nothing more than a halving of the miner’s reward. From 50, it reduced to 25 BTC per mined block, then to 12.5 BTC, continued to 6.25 BTC, and will continue to decrease until it reaches zero.

The halving is a process that affects miners and the price of Bitcoin. The next Bitcoin halving is expected to occur in April 2024.

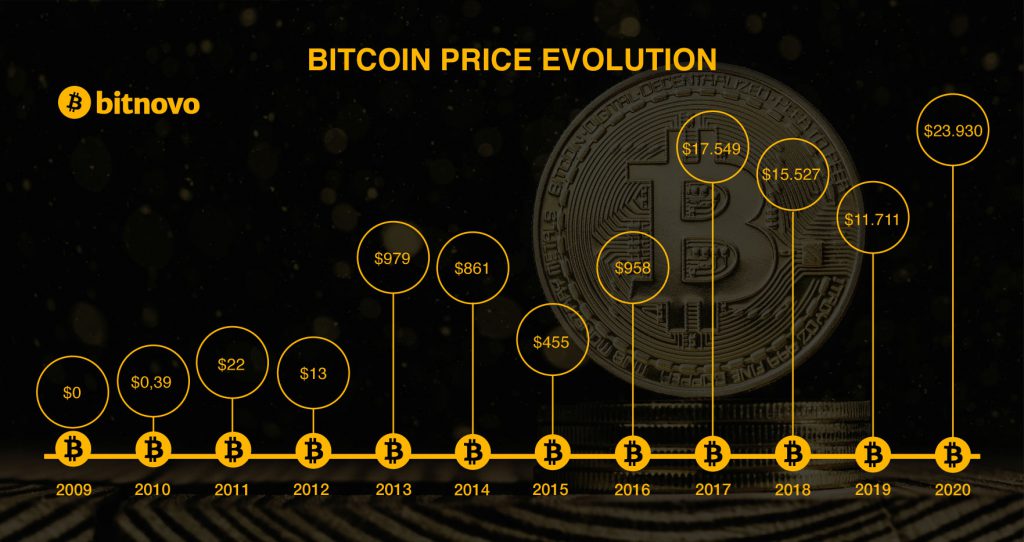

Evolution of the bitcoin price

Bitcoin has experienced a very volatile trading history since its creation in 2009. Initially, bitcoins were exchanged for almost nothing. If we consider that the first recorded transaction occurred on May 22, 2009, when a user bought a pizza for 10,000 BTC, equivalent to about $30.00 at that time, we can understand the magnitude of Bitcoin’s price evolution in the following years.

Since then, the price of Bitcoin has increased by a factor of 20 at its highest point. During 2021, it even reached a value exceeding $62,000. However, Bitcoin and other cryptocurrencies follow their market cycles.

How to Use Bitcoin?

The philosophy behind Bitcoin is based on the idea that you are the owner of your money, and only you can control it, without the need to store it in a bank or use a bank account to send money to another person.

You might be wondering, “Where do I store my bitcoins?” If you don’t already know, you can store your cryptocurrencies in a digital wallet, also known as a wallet in English.

Bitcoin Wallets

Wallets are used to store, send, receive, and even buy cryptocurrencies. Depending on the type of user you are, one type of wallet or another will work better for you.

Primarily, there are three types of wallets: software wallets, hardware wallets, and physical wallets. The most common for beginner users are software wallets, available for mobile devices or computers.

When choosing a wallet, it’s crucial to understand that its primary function will be to allow you to sign transactions with your cryptocurrencies and, of course, store them.

Self-custody wallets, those that make you the true owner of your crypto, will require you to create a 12 or 24-word phrase called a seed phrase. These random words should be stored physically with your important documents because having your seed phrase is what truly makes you the owner of your bitcoins. Whoever possesses this phrase will own your funds.

Once you’ve completed the initial setup of your wallet, you can send and receive bitcoins with it. Depending on your choice of wallet, you’ll have access to advanced tools. However, our recommendation is to keep it simple while you’re learning.

In self-custody but straightforward with Bitnovo Wallet

We invite you to try the Bitnovo wallet. This is a wallet that you can download from the App Store and Google Play Store, allowing you to store, send, receive, buy, sell your cryptocurrencies, and much more. Download the app [here](download link). Bitnovo’s Crypto Wallet.

How to Buy Bitcoin?

With Cash

You can acquire Bitcoin and other cryptocurrencies with cash in euros using Bitnovo vouchers.

It’s straightforward, just follow these steps:

- Download the free Bitnovo application or access their website and check the map with associated sales points.

- Choose the nearest sales point and purchase a Bitnovo voucher with the desired amount. With the purchase receipt issued by the seller, you can redeem it on the Bitnovo website or app.

- When redeeming, you will be asked for identity information and can select the cryptocurrency you want to purchase. With Bitnovo, you can choose from around 25 different types. Finally, enter your wallet address where you will receive the cryptocurrencies and the PIN indicated on the receipt.

- Once the transaction is confirmed, you just have to wait for the blockchain to validate the transaction to receive the cryptocurrencies in your wallet.

And voilà! You’ve bought Bitcoin with cash.

From the App or Computer

If you prefer to buy Bitcoin online, you only need to go to the Bitnovo website, select the cryptocurrency you want to buy, the amount you want to purchase, and, once you have provided the requested information, you can choose to pay by bank transfer, cryptocurrency, or card.

Once the payment is made and the transaction is confirmed on the blockchain, your BTC will arrive in your wallet in a few minutes.

How to Sell Bitcoin?

You can sell Bitcoin from the Bitnovo website. Choose the cryptocurrency you want to sell, specify the quantity, and, after completing the requested information, you can send the bitcoins and receive the bank transfer in your preferred account.

Once the transaction is confirmed on the Bitcoin network and validated by Bitnovo, your euros will be in your account in a few minutes.

Bitcoin: The Digital Gold

If we had to explain in simple terms what Bitcoin is, probably the best way would be this: Bitcoin is not just a currency but a revolution. As Wences Casares, entrepreneur and founder of Banco Lemon, said, “Right now, Bitcoin is like the internet before the browser.”

Who would have imagined a few decades ago that the internet would become our daily bread? We believe the same is happening with Bitcoin and thousands of other cryptocurrencies. The revolution is already underway, and cryptocurrencies are here to stay.

Do you want to be part of this great revolution?