Table of Contents

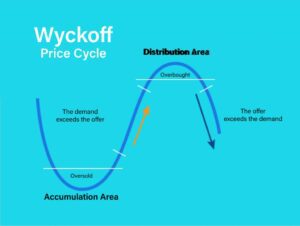

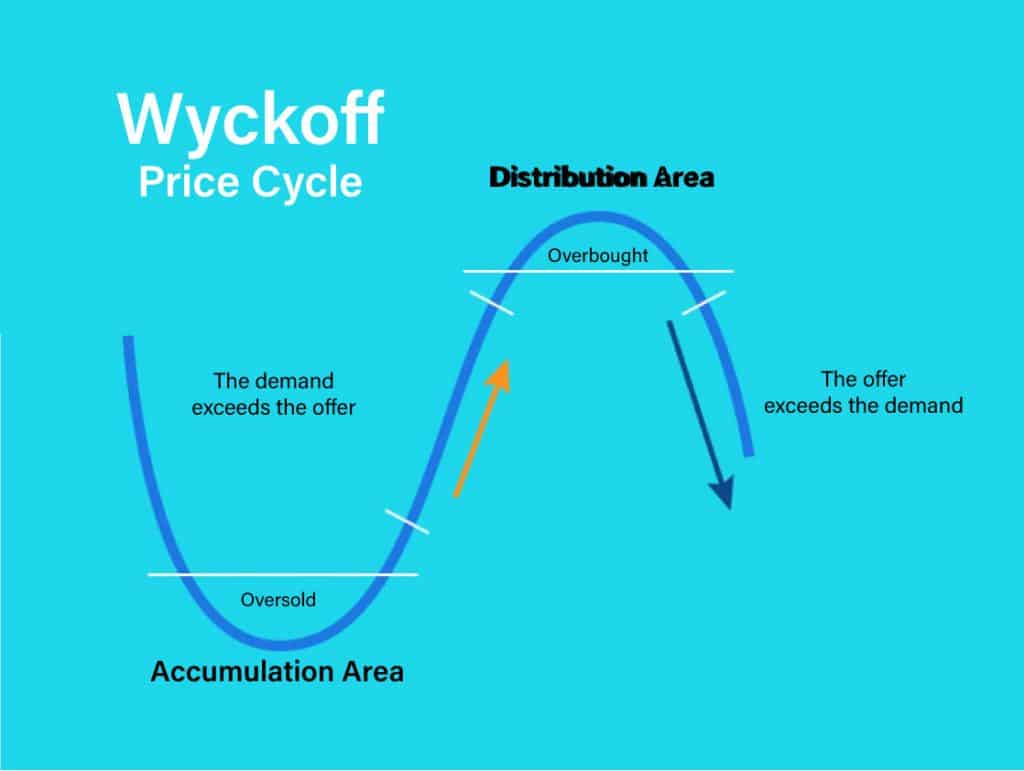

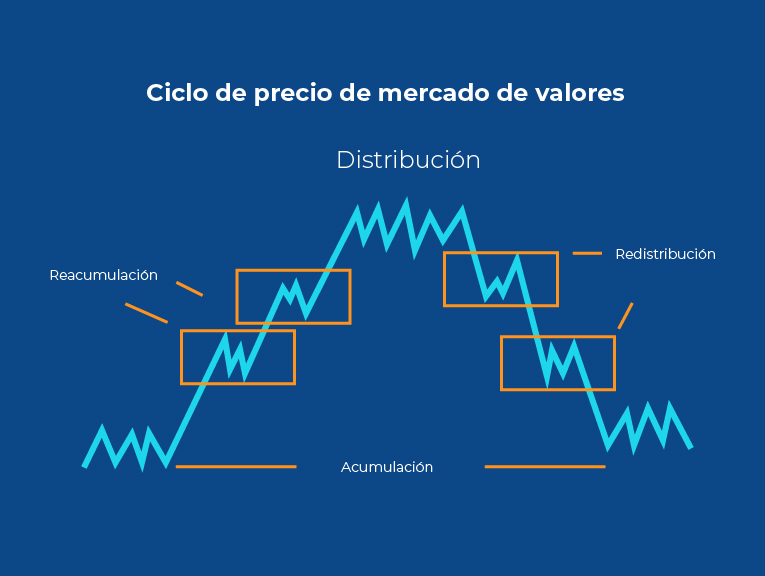

ToggleIt is clear that the market is fractal, and that the price over time returns to movements similar to past events. Market cycles should be a fundamental part of your technical analysis, as they will show you what phase you are in.

It is necessary to clarify that there are 3 phases in a market cycle; accumulation, expansion and distribution. In this article we will talk about each one of them, about how to get the most out of them by learning how to identify them.

Accumulation phase:

Generally, this cycle takes the longest to develop and the price usually moves within a fairly wide range. In this phase many investors position themselves cautiously and without leaving any traces. This is how they leave the trader with the speculation that we have entered the accumulation phase. This should be confirmed with the help of other concepts such as; price action and Japanese candlestick patterns. However, one can sense that we are starting or are in the middle of this cycle for 2 main reasons;

In this phase we usually hear negative news about this financial asset in the media, expressions that generate fear and uncertainty in the community, clearly small traders who are not mentally prepared can fall into this game and avoid entering the market while the big ones do.

The price after falling, will reach a point where it makes movements or impulses to then create a range or zone to buy. This is where you will need to employ analytical skills and concepts such as price action, candlestick patterns and understanding Wyckoff’s theory. This way you will understand more accurately and be more likely to get your entries right.

Expansion phase:

As the name implies, for this cycle the price expands, marking a trend either up or down. Normally in this phase most traders enter, since you hear about great news and create a feeling of “FOMO” (Fear of missing out) widely used in the crypto environment. This phase is characterized by strong impulses, short retracements and the trader should know how to take advantage of the long or short entries according to the trend of the expansion phase.

The media and large investors for this phase will provide positive information, as long as the trend is upward so that retailers enter the market to buy and thus inject more liquidity to the impulses. On the other hand, if the trend is downwards, the news will be negative, encouraging sales.

Distribution Phase:

It is known to be the cycle where large investors liquidate their positions and make numerous sales transactions. They also often make candlestick patterns or upward impulses to fool you into thinking that the expansion phase is not yet over.

You can identify it because it is located in very high areas and possibly in areas of resistance where the price has reacted in the past. If, otherwise, it has no resistance but is at historical highs you will have to leverage other knowledge such as Eliot and Fibonacci waves.

This will help you to have a little more precision as far as the distribution phase could settle.

This phase of the market cycle has one fundamental characteristic which is:

- The media will report positive and euphoric news, indicating to the trader that the best time to enter the market is when the financial asset or crypto asset is purchased. This is how you are encouraged to enter the fresh capital market, which can give liquidity to the sales volumes of the great investor.