Table of Contents

ToggleOne quality that crypto-users share, especially those of us who have made DeFi our home, is the impossibility of staying still. This implies, moving a lot between blockchains, and the “wrapped tokens” have really calmed our craving for free circulation.

As I have already told in this blog, blockchains in their beginnings were isolated from each other. A BTC holder, if he wanted to trade on Ethereum, had to sell his bitcoins and buy Ethereum coins on an exchange, and then send them to that network.

The “wrapped tokens” came to simplify our paths in terms of connections between networks. In simple words, in a wrapped token, the source coin is “wrapped” in the code of the target blockchain and thus, it circulates in it without problems. Let’s see how this interesting concept works.

How does a Wrapped Token work?

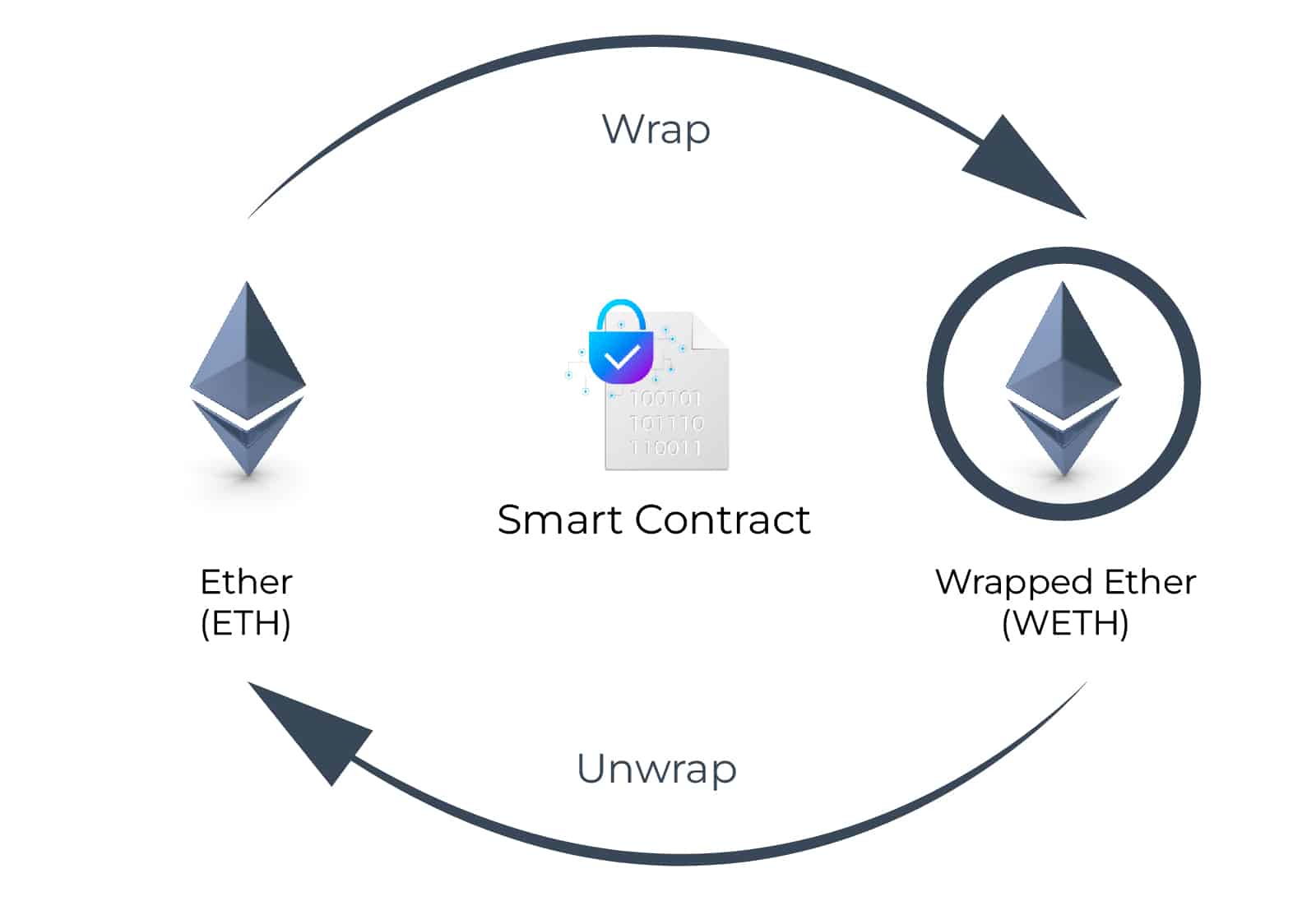

As I mentioned in the introduction to this article, a “wrapped token” is a token that wraps another token or cryptocurrency, external to the blockchain, in the code necessary to be able to “circulate” on the blockchain and thus interact with the decentralized applications on it.

The initial definition may sound a bit complex but by explaining each part we will be able to better understand what this type of token is all about. First, we must understand that each blockchain, at first, is isolated from the rest of the planet. In addition, they usually have their own code or way of programming their coins. This last feature makes their coins incompatible with other blockchains.

Therefore, “wrapped tokens” are the representation of a currency external to the blockchain, in a one-to-one relationship with respect to its value, but “wrapped” in the code of the network in which this wrapped token will circulate.

An exemplified wrapped token

In order to illustrate it in a simple way, let’s see an example. Let’s imagine that I have bitcoin in my possession, I don’t want to sell it, but I would like to generate some passive income with it. We know that in the Bitcoin network this possibility does not exist. However, Ethereum has an extremely varied DeFi ecosystem. How could I use my BTC in Ethereum? Through a bitcoin “wrapped token”.

In a nutshell, this would be nothing more than BTC wrapped in the code corresponding to the ERC-20 standard, which allows any token to circulate freely on the Ethereum blockchain and be used on its various smart platforms.

This simple example, to understand what a “wrapped token” is, gives us a bit of crypto-history.

The birth of wrapped tokens

The example in the previous section merely builds on the genesis of the concept of “wrapped tokens”. In 2019, in a joint action taken by industry giants such as Kyber Network, BitGo and Republic Protocol, they decided it was time to bring bitcoin to Ethereum.

With this move, they would allow users to be able to use a token representing bitcoin within Ethereum and, more importantly, within the DeFi world.

So how did they plan to take it forward? As follows:

- A wallet was created on the Bitcoin network, to which users who wanted a “wrapped bitcoin”, had to send their BTC.

- On the Ethereum side, a smart contract was created that created a token under the ERC standard – 20.

- This token, called wBTC, replicated the price of bitcoin within Ethereum, where it could be used

- The one-to-one parity between wBTC and BTC is guaranteed by the deposits in the Bitcoin network wallet.

- wBTC holders can burn it and get their BTC back on the Bitcoin network whenever they want.

It is interesting to note that the management of wBTC is done in a centralized manner. There is a certain number of people in control of the wallet on the bitcoin side, who guard these tokens. Anyway, its creation gave rise to a kind of “revolution” in the crypto-world and, above all, in the DeFi ecosystem.

Projects such as Ren Protocol, led the creation of “wrapped tokens”, such as renBTC, in a decentralized way, enhancing the interconnection between different blockchains and maintaining the “Cypher Punk” spirit.

Advantages and risks of wrapped tokens

Now that we know what a wrapped token is, its history and we have a clear example, it is time for analysis. As with every tool we have in the crypto ecosystem, it is necessary to dwell on both its advantages and the risks involved in its use.

After having investigated in detail both sides of the “tokens involved”, we can turn to our scales and evaluate whether it is a token that we will use or not.

But, without further ado, let’s move on to the analysis.

Advantages

The benefits of this type of tokens can be grouped into two different categories. Let’s simplify the approaches by going through each of them.

Economic advantages

Undoubtedly, this is the first benefit to be derived from them. In the example of the first section of the article, the user who decides to “wrap” his BTC to become the owner of wBTC in the Ethereum network, intends to make an economic benefit.

These wrapped tokens, can be used in different decentralized applications, those that make up the vast DeFi ecosystem. In them, you will get a return for depositing these tokens and they can even be used as collateral or guarantee to obtain a loan.

Perhaps, at the end of his adventure in the DeFi world, this user can count on some extra “satoshis”…

Philosophical advantages

Beyond the economic and technological aspects, our environment is crossed by a philosophical current, which brings together the principles set out by Satoshi when he built Bitcoin. These principles, taken from the “Cypher Punk” current, find freedom as one of its pillars.

Although bitcoin gives us freedom from different angles, as we are restricted to its use only within this network, our possibilities are intrinsically limited.

Wrapped tokens give us the possibility to explore new networks, without the need to part with our main or original assets. The dream of the multichain ecosystem is materialized through these tokens.

Risks

We have already had time to get used to and, above all, to learn first-hand that the crypto world is made of benefits, but also of risks. Every time we use a smart contract, we are not only enjoying its benefits, but also exposing ourselves to its inherent risks.

On the one hand, we are exposed to:

- Hacking risks

- Bugs or errors in the development

In the case of wrapped tokens, not only do we expose ourselves to risk in the destination network, we also expose ourselves to risk in the originating network. WBTC is a great example. By sending our BTC to the wallet that holds them within the Bitcoin blockchain, we face the potential risk of a hack or theft of funds against it. In this case, we double our risks, those intrinsic to the Bitcoin network and those derived from Ethereum smart contracts.

On the other hand, I cannot fail to mention that, by using wBTC, we also expose ourselves to the risk inherent to centralization. This one, is very simple to observe. As long as there are a certain number of people behind the custody of certain funds, the possibility of disappearing with them, will be latent.

In any case, it is important to clarify that to date we have not found any of these ungrateful events related to the most used “wrapped tokens” platforms.

The curious case of wETH

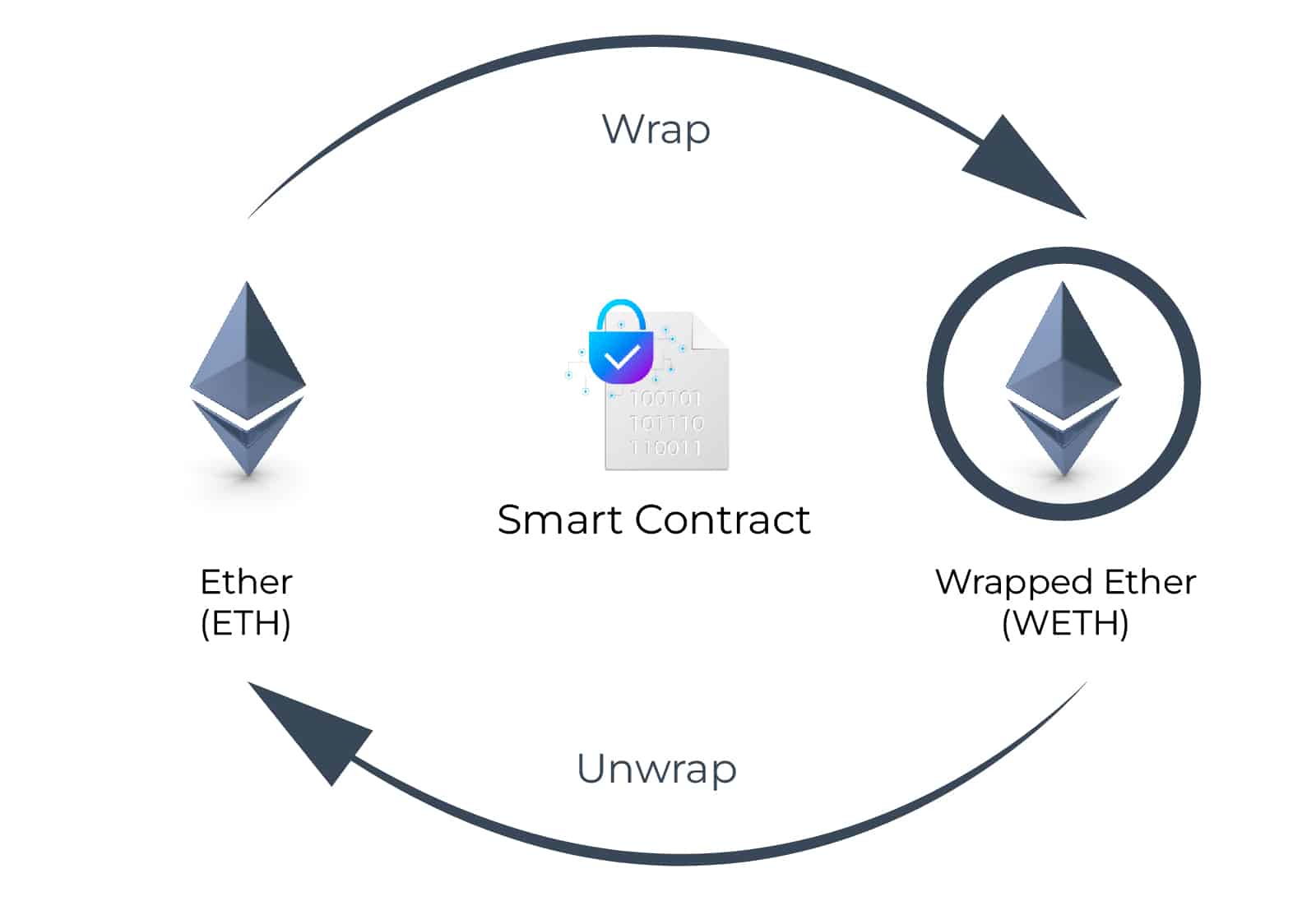

After reading this article, you may be surprised to come across a token called wETH while browsing through different decentralized applications. As its name suggests, it is an ETH token wrapped in the code established by the ERC-20 standard.

Now, why would it be necessary to “wrap” ETH in this code? The explanation is simple. ETH is the native token of the Ethereum network, the one that was born alongside the blockchain and was encoded within its same protocol. The rest of the tokens circulating in Ethereum were created by a smart contract, mostly following the ERC – 20 standard.

After being installed as a standard, most of the applications in this network were built to support and interact with ERC-20 tokens. Thus, the use of wETH is a way to simplify the interaction of crypto-users with these platforms.

A look at the future of wrapped tokens

It is clear that Ethereum’s greatest contribution to the crypto-universe has been the creation of smart contracts. Thanks to them, we have decentralized applications, an infinite number of different tokens and a DeFi ecosystem full of options, based on these foundations.

However, it is still a risky tool. As the number of smart contracts our money goes through increases, so will our exposure to risk.

However, for those of us who dream of a multichain future, we are confident that the security of these pieces of computing will continue to increase. In that ideal scenario, wrapped tokens will continue to connect networks and allow us to move freely.

What are wrapped tokens?

Table of Contents

ToggleOne quality that crypto-users share, especially those of us who have made DeFi our home, is the impossibility of staying still. This implies, moving a lot between blockchains, and the “wrapped tokens” have really calmed our craving for free circulation.

As I have already told in this blog, blockchains in their beginnings were isolated from each other. A BTC holder, if he wanted to trade on Ethereum, had to sell his bitcoins and buy Ethereum coins on an exchange, and then send them to that network.

The “wrapped tokens” came to simplify our paths in terms of connections between networks. In simple words, in a wrapped token, the source coin is “wrapped” in the code of the target blockchain and thus, it circulates in it without problems. Let’s see how this interesting concept works.

How does a Wrapped Token work?

As I mentioned in the introduction to this article, a “wrapped token” is a token that wraps another token or cryptocurrency, external to the blockchain in question, in the code necessary to be able to “circulate” on the blockchain and thus interact with the decentralized applications on it.

The initial definition may sound a bit complex but by explaining each part we will be able to better understand what this type of token is all about. First, we must understand that each blockchain, at first, is isolated from the rest of the planet. In addition, they usually have their own code or way of programming their coins. This last feature makes their coins incompatible with other blockchains.

Therefore, “wrapped tokens” are the representation of a currency external to the blockchain, in a one-to-one relationship with respect to its value, but “wrapped” in the code of the network in which this wrapped token will circulate.

An exemplified wrapped token

AIn order to illustrate it in a simple way, let’s see an example. Let’s imagine that I have bitcoin in my possession, I don’t want to sell it, but I would like to generate some passive income with it. We know that in the Bitcoin network this possibility does not exist. However, Ethereum has an extremely varied DeFi ecosystem. How could I use my BTC in Ethereum? Through a bitcoin “wrapped token”.

In a nutshell, this would be nothing more than BTC wrapped in the code corresponding to the ERC-20 standard, which allows any token to circulate freely on the Ethereum blockchain and be used on its various smart platforms.

This simple example, to understand what a “wrapped token” is, gives us a bit of crypto-history.

The birth of wrapped tokens

The example in the previous section merely builds on the genesis of the concept of “wrapped tokens”. In 2019, in a joint action taken by industry giants such as Kyber Network, BitGo and Republic Protocol, they decided it was time to bring bitcoin to Ethereum.

With this move, they would allow users to be able to use a token representing bitcoin within Ethereum and, more importantly, within the DeFi world.

So how did they plan to take it forward? As follows:

- A wallet was created on the Bitcoin network, to which users who wanted a “wrapped bitcoin” had to send their BTC.

- On the Ethereum side, a smart contract was created that created a token under the ERC standard – 20.

- This token, called wBTC, replicated the price of bitcoin inside Ethereum, where it could be used

- The one-to-one parity between wBTC and BTC is guaranteed by the deposits in the Bitcoin network wallet.

- wBTC holders can burn it and get their BTC back on the Bitcoin network whenever they want.

It is interesting to note that the management of wBTC is done in a centralized manner. There is a certain number of people in control of the wallet on the bitcoin side, who guard these tokens. Anyway, its creation gave rise to a kind of “revolution” in the crypto-world and, above all, in the DeFi ecosystem.

Projects such as Ren Protocol, led the creation of “wrapped tokens”, such as renBTC, in a decentralized way, enhancing the interconnection between different blockchains and maintaining the “Cypher Punk” spirit.

Advantages and risks of wrapped tokens

Now that we know what a wrapped token is, its history and we have a clear example, it is time for analysis. As with every tool we have in the crypto ecosystem, it is necessary to dwell on both its advantages and the risks involved in its use.

After having investigated in detail both sides of the “tokens involved”, we can turn to our scales and evaluate whether it is a token that we will use or not.

But, without further ado, let’s move on to the analysis.

Advantages

The benefits of this type of tokens can be grouped into two different categories. Let’s simplify the approaches by going through each of them.

Economic advantages

Undoubtedly, this is the first benefit to be derived from them. In the example of the first section of the article, the user who decides to “wrap” his BTC to become the owner of wBTC in the Ethereum network, intends to make an economic benefit.

These wrapped tokens, can be used in different decentralized applications, those that make up the vast DeFi ecosystem. In them, you will get a return for depositing these tokens and they can even be used as collateral or guarantee to obtain a loan.

Perhaps, at the end of his adventure in the DeFi world, this user can count on some extra “satoshis”…

Philosophical advantages

Beyond the economic and technological aspects, our environment is crossed by a philosophical current, which brings together the principles set out by Satoshi when he built Bitcoin. These principles, taken from the “Cypher Punk” current, find freedom as one of its pillars.

Although bitcoin gives us freedom from different angles, as we are restricted to its use only within this network, our possibilities are intrinsically limited.

Wrapped tokens give us the possibility to explore new networks, without the need to part with our main or original assets. The dream of the multichain ecosystem is materialized through these tokens.

Risks

We have already had time to get used to and, above all, to learn first-hand that the crypto world is made of benefits, but also of risks. Every time we use a smart contract, we are not only enjoying its benefits, but also exposing ourselves to its inherent risks.

On the one hand, we are exposed to:

- Hacking risks

- Bugs or errors in development

In the case of wrapped tokens, not only do we expose ourselves to risk in the destination network, we also expose ourselves to risk in the originating network. WBTC is a great example. By sending our BTC to the wallet that holds them within the Bitcoin blockchain, we face the potential risk of a hack or theft of funds against it. In this case, we double our risks, those intrinsic to the Bitcoin network and those derived from Ethereum smart contracts.

On the other hand, I cannot fail to mention that, by using wBTC, we also expose ourselves to the risk inherent to centralization. This one, is very simple to observe. As long as there are a certain number of people behind the custody of certain funds, the possibility of disappearing with them, will be latent.

In any case, it is important to clarify that to date we have not found any of these ungrateful events related to the most used “wrapped tokens” platforms.

The curious case of wETH

After reading this article, you may be surprised to come across a token called wETH while browsing through different decentralized applications. As its name suggests, it is an ETH token wrapped in the code established by the ERC-20 standard.

Now, why would it be necessary to “wrap” ETH in this code? The explanation is simple. ETH is the native token of the Ethereum network, the one that was born alongside the blockchain and was encoded within its same protocol. The rest of the tokens circulating in Ethereum were created by a smart contract, mostly following the ERC – 20 standard.

After being installed as a standard, most of the applications in this network were built to support and interact with ERC-20 tokens. Thus, the use of wETH is a way to simplify the interaction of crypto-users with these platforms.

A look at the future of wrapped tokens

It is clear that Ethereum’s greatest contribution to the crypto-universe has been the creation of smart contracts. Thanks to them, we have decentralized applications, an infinite number of different tokens and a DeFi ecosystem full of options, based on these foundations.

However, it is still a risky tool. As the number of smart contracts our money goes through increases, so will our exposure to risk.

However, for those of us who dream of a multichain future, we are confident that the security of these pieces of computing will continue to increase. In that ideal scenario, wrapped tokens will continue to connect networks and allow us to move freely.