Table of Contents

ToggleThis week we have experienced another chilling chapter in the never-ending series called “Don’t leave your cryptocurrencies in custody“. The stellar performance of Celsius and the freezing of its users’ funds could be an Oscar nominee for best short fiction film. And Binance’s temporary ban on Bitcoin withdrawals would certainly contend for a statuette for best editing.

It is very difficult to explain the problem that custody poses to users who are new to the world of cryptocurrencies, but when you buy Bitcoin or other cryptos and leave them inside those “cryptocurrency banks” such as Binance or Celsius, you do not own them. It’s literally like having your money in the bank: the same old system, but with cryptocurrencies.

While many people choose this practice for convenience and because they do not want to bear the responsibility for the security of their funds, it is clear that the results can be very counterproductive and we have seen this on multiple occasions over the years.

For many years we at Bitnovo have been proposing to users to take their cryptocurrencies out of these companies and send them to their own wallets, but there are few voices and it is very difficult to be heard among so many companies that continually proclaim the antagonistic message in order to obtain deposits and generate profits using the cryptocurrencies of their users.

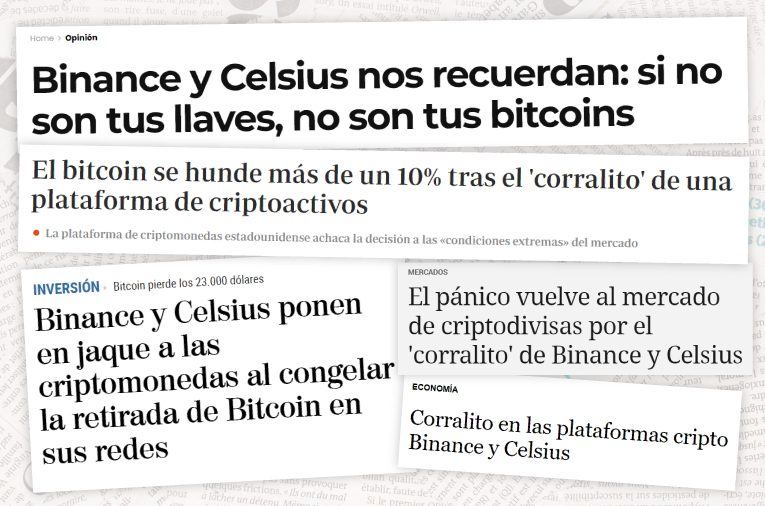

The Celsius “corralito”

This is how newspapers such as ABC or La Voz de Galicia it because at the beginning of the week this platform decided to suspend all withdrawals, exchanges and transfers between accounts of its users, alleging “extreme conditions” of the market.

On their official blog they clarified, “We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations.”

A “cryptocurrency bank” in all its glory, behaving like the Argentine banks in December 2001, the Cypriot banks in 2013 or the Greek banks in 2015 and making it impossible for its users to dispose of their own money.

Binance’s temporary breaks

“Binance suspends Bitcoin withdrawals in the midst of collapse” headlines El Economista, while Infobae headlines “why Binance put a corralito to bitcoin”, and so hundreds of news portals around the world.

It is impossible to encourage the entry of new users to an ecosystem that surpasses governments and traditional banks, if we repeat the worst mistakes of the old centralized and manipulated system that we say we want to change.

On Monday Binance did it again, suspending Bitcoin withdrawals to all its users, coincidentally, amid a sharp drop in the price of BTC.

Sovereignty as a banner of liberation29

As the famous phrase “Not your keys, not your coins” says, “if you don’t own your keys, you don’t own your coins”.

Choosing self-custody over “cryptocurrency banks” is choosing to be sovereign and to support the foundations of a technology that came to free us from an obsolete system based on control by the powerful.